U.S. Loan Market 2026- The U.S. loan market is entering 2026 with a complex mix of steady consumer demand, elevated interest rates, and tighter lending standards. From mortgages and auto loans to student and small business financing, Americans are navigating a credit environment shaped by Federal Reserve policy, inflation trends, and evolving banking regulations. While borrowing activity remains resilient, higher costs and stricter underwriting are reshaping how households and businesses access credit across the country.

Interest Rates Remain the Defining Factor

After two years of aggressive rate hikes aimed at curbing inflation, the Federal Reserve’s benchmark interest rate remains significantly higher than pre-pandemic levels. Although inflation has moderated compared to its peak, borrowing costs for consumers are still elevated.

Mortgage rates have hovered well above the historic lows seen in 2020–2021, affecting both homebuyers and refinancing activity. According to industry data, 30-year fixed mortgage rates have remained in the mid-to-high range compared to pandemic-era averages. This shift has cooled home affordability and slowed refinancing applications, even as housing demand persists in major metropolitan areas.

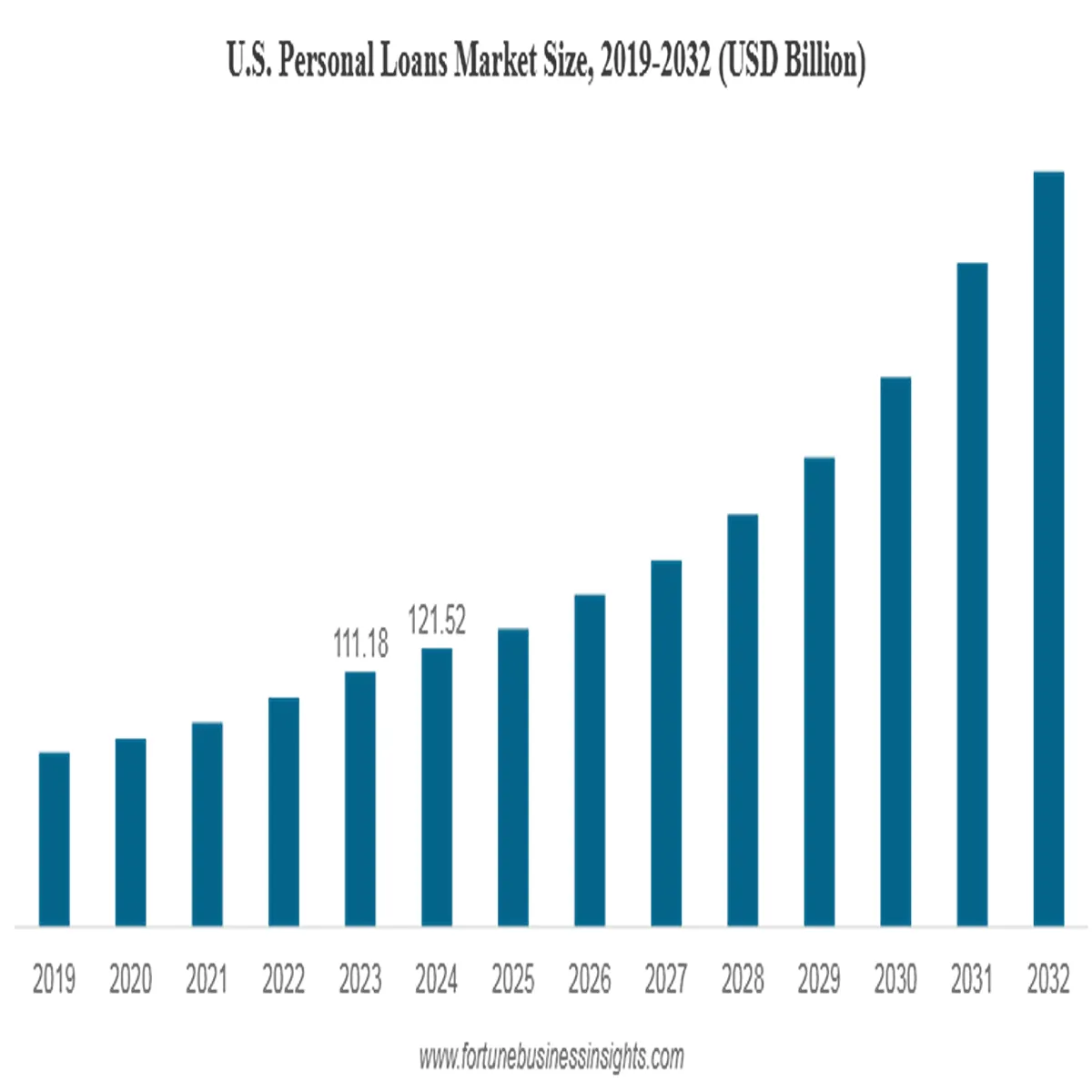

Personal loans and credit card APRs have also climbed. With the average credit card interest rate at multi-decade highs, more Americans are turning to structured personal loans to consolidate debt and manage monthly payments more predictably.

Mortgage Lending Shows Signs of Adjustment

Higher rates have slowed new home purchases, but they have not eliminated demand. In regions such as Texas, Florida, and parts of the Midwest, population growth continues to support housing activity. However, lenders report that buyers are increasingly sensitive to rate fluctuations.

Refinancing volumes remain subdued compared to pandemic levels, as most homeowners who secured historically low rates are hesitant to refinance at higher costs. Adjustable-rate mortgages (ARMs), once less common, are regaining limited interest among qualified borrowers seeking lower initial payments.

At the same time, underwriting standards remain tighter than in the years preceding the 2008 financial crisis. Banks are emphasizing credit scores, debt-to-income ratios, and documented income stability. This conservative approach reflects both regulatory oversight and lessons from past credit cycles.

Auto Loans Face Rising Delinquency Rates

Auto lending has been one of the most closely watched segments in the U.S. loan market. Vehicle prices surged during supply chain disruptions, pushing average loan balances to record levels. Combined with higher interest rates, this has increased monthly payments for many borrowers.

Recent data indicates a gradual rise in auto loan delinquencies, particularly among subprime borrowers. Financial institutions are responding by tightening approval standards and requiring larger down payments in certain cases.

Despite these challenges, auto loan originations remain steady due to continued consumer demand and improving vehicle inventory levels. Analysts suggest that while delinquency rates are rising, they are not yet at levels that signal systemic stress across the broader credit market.

Student Loans Resume as Policy Shifts Take Effect

Federal student loan repayments resumed after the pandemic-era pause, marking a significant change for millions of Americans. Borrowers are adjusting household budgets to accommodate monthly payments once again.

Income-driven repayment plans and targeted forgiveness initiatives have reshaped how federal student debt is managed. However, policy uncertainty and legal challenges have created confusion for some borrowers. Private student loan lenders, meanwhile, are seeing renewed interest from families seeking alternatives to federal limits.

The return of student loan payments has also affected discretionary spending patterns, with economists monitoring its broader impact on retail and consumer credit trends.

Small Business Lending Reflects Economic Caution

Small business owners continue to rely on credit for expansion, payroll, and inventory management. However, access to affordable financing has become more selective. Traditional banks are exercising caution, particularly for startups or businesses in volatile sectors.

Government-backed lending programs remain important tools for entrepreneurs. Programs supported by agencies such as the Small Business Administration (SBA) continue to provide structured financing options with federal guarantees, helping mitigate lender risk.

Online lenders and fintech platforms are also gaining traction, offering faster approval processes and digital-first applications. While these platforms provide convenience, borrowers are advised to review terms carefully, as interest rates and fees can vary widely.

Consumer Behavior Shifts Toward Debt Management

With borrowing costs elevated, American consumers are demonstrating more deliberate credit behavior. Many households are prioritizing debt consolidation loans to manage high-interest credit card balances. Financial advisors report growing interest in fixed-rate personal loans as a strategy to stabilize monthly payments.

Savings rates have fluctuated amid inflation pressures, prompting some households to rely more heavily on short-term credit products. However, surveys show that consumers are increasingly comparing APRs, lender transparency, and repayment flexibility before committing to new loans.

Digital comparison tools and online marketplaces have made it easier for borrowers to evaluate options side-by-side, intensifying competition among lenders.

Regulatory Oversight and Banking Stability

U.S. regulators continue to monitor the loan market closely following regional banking stresses seen in recent years. Capital requirements, liquidity standards, and stress testing remain central to ensuring financial system resilience.

Banks are balancing profitability with prudent risk management. Commercial real estate loans, in particular, are under scrutiny due to evolving office space demand and refinancing challenges in a higher-rate environment.

Despite these pressures, overall credit availability has not collapsed. Instead, the market reflects a recalibration — one that emphasizes responsible lending practices and borrower qualification standards.

Outlook: What Borrowers Should Watch in 2026

Looking ahead, the direction of interest rates will remain the most significant factor influencing the U.S. loan market. Any sustained cooling of inflation could create room for policy adjustments, potentially easing borrowing costs. Conversely, persistent price pressures may keep rates elevated for longer.

For consumers, maintaining strong credit scores, monitoring debt-to-income ratios, and comparing loan offers across multiple lenders will be critical strategies. For businesses, diversified funding sources and careful cash flow planning may help offset tighter lending conditions.

While challenges persist, the U.S. loan market remains fundamentally active and adaptive. Borrowers and lenders alike are adjusting to a new normal defined by higher rates, stronger oversight, and a renewed focus on long-term financial stability.