U.S. Loan- The U.S. loan market is entering 2026 with renewed focus from consumers, lenders, and policymakers as interest rates remain elevated and credit standards continue to tighten. From mortgage borrowing and auto financing to personal loans and small-business credit, Americans are adjusting to a lending environment shaped by higher borrowing costs, stricter underwriting, and shifting economic signals. Recent data from the Federal Reserve and major financial institutions show that while demand for loans remains resilient, borrowers are becoming more cautious about taking on new debt.

Mortgage Rates Remain Key Pressure Point for Homebuyers

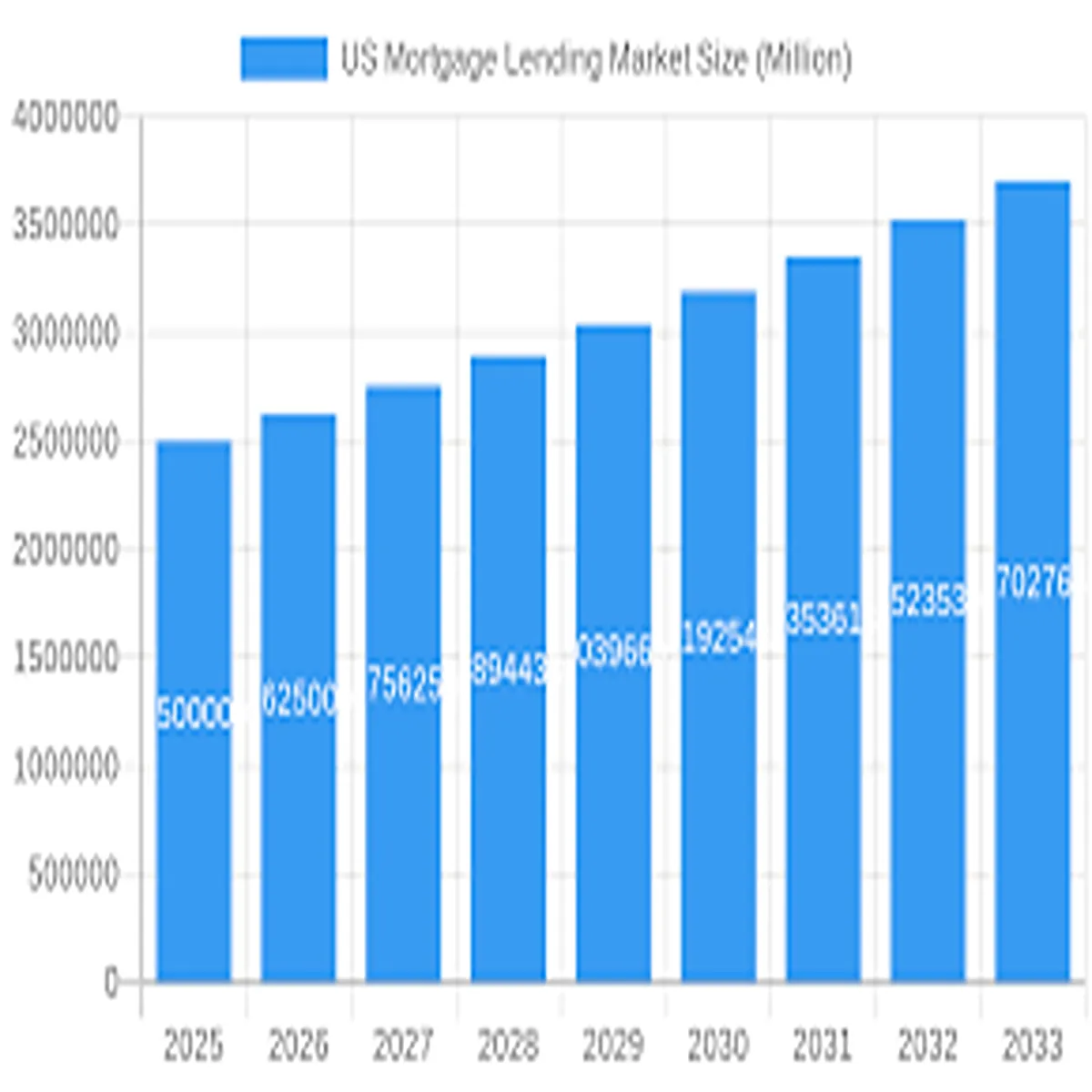

Mortgage loans continue to dominate discussions in the U.S. credit market. According to recent updates from the Federal Reserve, benchmark interest rates have stayed at elevated levels compared to the ultra-low rates seen during 2020–2021. As a result, average 30-year fixed mortgage rates have hovered well above pre-pandemic norms, impacting affordability nationwide.

Higher mortgage rates have cooled refinancing activity significantly, while purchase demand has remained uneven across regions. Markets in the Midwest and parts of the South are seeing steadier activity due to relatively lower home prices, while coastal metro areas continue to face affordability constraints.

Lenders report that credit score requirements remain firm, and down payment expectations have not eased substantially. Borrowers with strong credit profiles continue to secure better terms, but first-time buyers are increasingly relying on adjustable-rate mortgages and down payment assistance programs to enter the housing market.

Personal Loans See Steady Growth Amid Credit Card Fatigue

Personal loans have gained traction as consumers look for alternatives to high-interest credit card balances. With average credit card APRs remaining historically high, many borrowers are turning to fixed-rate installment loans to consolidate debt.

Industry data shows that fintech lenders and traditional banks alike are reporting moderate growth in unsecured personal loan originations. However, approval standards have tightened, particularly for applicants with lower credit scores.

Analysts say consumers are prioritizing predictable monthly payments and transparent loan terms. This shift reflects broader financial caution, as households manage inflation pressures, student loan repayments, and rising living costs.

Auto Loan Market Faces Delinquency Concerns

Auto loans represent another significant segment of the U.S. lending landscape. While vehicle inventory levels have improved compared to pandemic shortages, higher car prices combined with increased financing rates have pushed average monthly payments upward.

Recent credit performance reports indicate that auto loan delinquencies have inched higher, particularly among subprime borrowers. Lenders are responding by adjusting underwriting standards and offering shorter loan terms to mitigate risk.

Industry experts emphasize that while delinquency rates remain below historical crisis levels, the trend is being closely monitored by regulators and financial institutions alike.

Small Business Lending Shows Signs of Stabilization

Small businesses continue to rely on credit lines and term loans to manage expansion and working capital needs. Following tighter credit conditions in recent years, lending activity is showing signs of stabilization.

Community banks and regional lenders have reported steady demand, especially from service-based businesses and local retailers. However, businesses in sectors sensitive to consumer spending fluctuations remain cautious about borrowing.

Government-backed loan programs, including those administered through the Small Business Administration, remain a critical source of financing for startups and minority-owned enterprises.

Student Loan Repayment Reshapes Household Budgets

The resumption of federal student loan repayments has reshaped borrowing decisions for millions of Americans. Payment obligations have reduced disposable income for many households, influencing decisions around mortgages, auto loans, and personal credit.

Financial planners note that borrowers are reassessing debt priorities, often focusing on building emergency savings before taking on additional loans. This behavioral shift could moderate loan demand in certain segments throughout 2026.

Banks Tighten Credit Standards Amid Economic Uncertainty

Quarterly lending surveys indicate that banks have maintained tighter credit standards across multiple loan categories. Concerns about economic growth, labor market stability, and inflation continue to influence lending strategies.

At the same time, large institutions such as JPMorgan Chase and Bank of America have emphasized strong capital positions and disciplined risk management practices in recent earnings updates. These institutions report stable consumer credit performance overall, though they acknowledge pockets of stress in lower-income segments.

Digital Lending Platforms Continue to Expand

Online lending platforms are playing a growing role in shaping borrower experiences. Digital-first companies are leveraging automation to streamline loan applications, offering faster approvals and simplified documentation processes.

While digital lending expands access, regulators continue to scrutinize underwriting transparency and consumer protections. Borrowers are advised to review loan terms carefully, including APR, fees, and repayment flexibility, before committing.

What Borrowers Should Watch in 2026

Financial experts suggest that prospective borrowers monitor Federal Reserve policy signals, employment trends, and inflation data, all of which influence interest rate direction. Even modest rate adjustments can significantly affect monthly payments on mortgages, auto loans, and personal credit.

Consumers with strong credit scores, stable income, and manageable debt-to-income ratios remain best positioned to secure favorable terms. Meanwhile, financial advisors recommend comparing multiple lenders, reviewing pre-approval options, and understanding total loan costs beyond headline interest rates.

The Bottom Line

The U.S. loan market in 2026 reflects a period of normalization after years of extraordinary monetary conditions. While higher interest rates present challenges, credit remains available for qualified borrowers. From mortgages and personal loans to auto and small business financing, lending activity continues — albeit with greater caution and stricter underwriting.

For American households and businesses alike, informed decision-making and careful financial planning are proving essential in navigating today’s lending environment.