U.S. Insurance Market 2026- The U.S. insurance industry is entering 2026 under mounting pressure from inflation, climate-related disasters, healthcare costs, and evolving consumer expectations. From auto and homeowners coverage to health and life policies, Americans are seeing noticeable changes in premiums, underwriting standards, and digital services. Industry data from federal agencies and leading insurers suggests that while the market remains financially stable overall, affordability and risk management are emerging as defining themes for consumers across the country.

Auto Insurance Rates Continue Upward Trend

Auto insurance remains one of the most searched financial topics in the United States, and for good reason. According to recent market analyses and public filings from major carriers such as State Farm and Allstate, average auto insurance premiums increased significantly over the past two years.

Industry reports attribute the rise to higher repair costs, expensive vehicle technology, increased accident severity, and supply chain disruptions that have pushed up replacement part prices. Electric vehicles, while environmentally friendly, often come with higher repair costs due to specialized components and battery systems.

Data from the Insurance Information Institute indicates that insurers are also adjusting pricing models to reflect regional risk trends, including weather-related damage and urban traffic density. Consumers in states such as Florida, California, and Louisiana continue to experience above-average rate hikes due to higher claims frequency and catastrophic exposure.

Homeowners insurance is undergoing significant recalibration as insurers respond to intensifying natural disasters. In hurricane-prone states and wildfire-affected regions, carriers are reassessing risk exposure, tightening underwriting standards, and in some cases limiting new policy issuance.

Federal disaster data from agencies such as the Federal Emergency Management Agency shows a steady rise in billion-dollar weather events over the last decade. As rebuilding costs increase due to labor shortages and material inflation, insurers are revising coverage terms and deductibles.

In California, wildfire risk modeling has led some insurers to pause new policies in high-risk ZIP codes. Meanwhile, in coastal Florida, policyholders are seeing higher windstorm deductibles and stricter inspection requirements. State regulators are responding with reform measures aimed at stabilizing local insurance markets, but affordability remains a central concern for homeowners.

Health Insurance Costs and Coverage Shifts in 2026

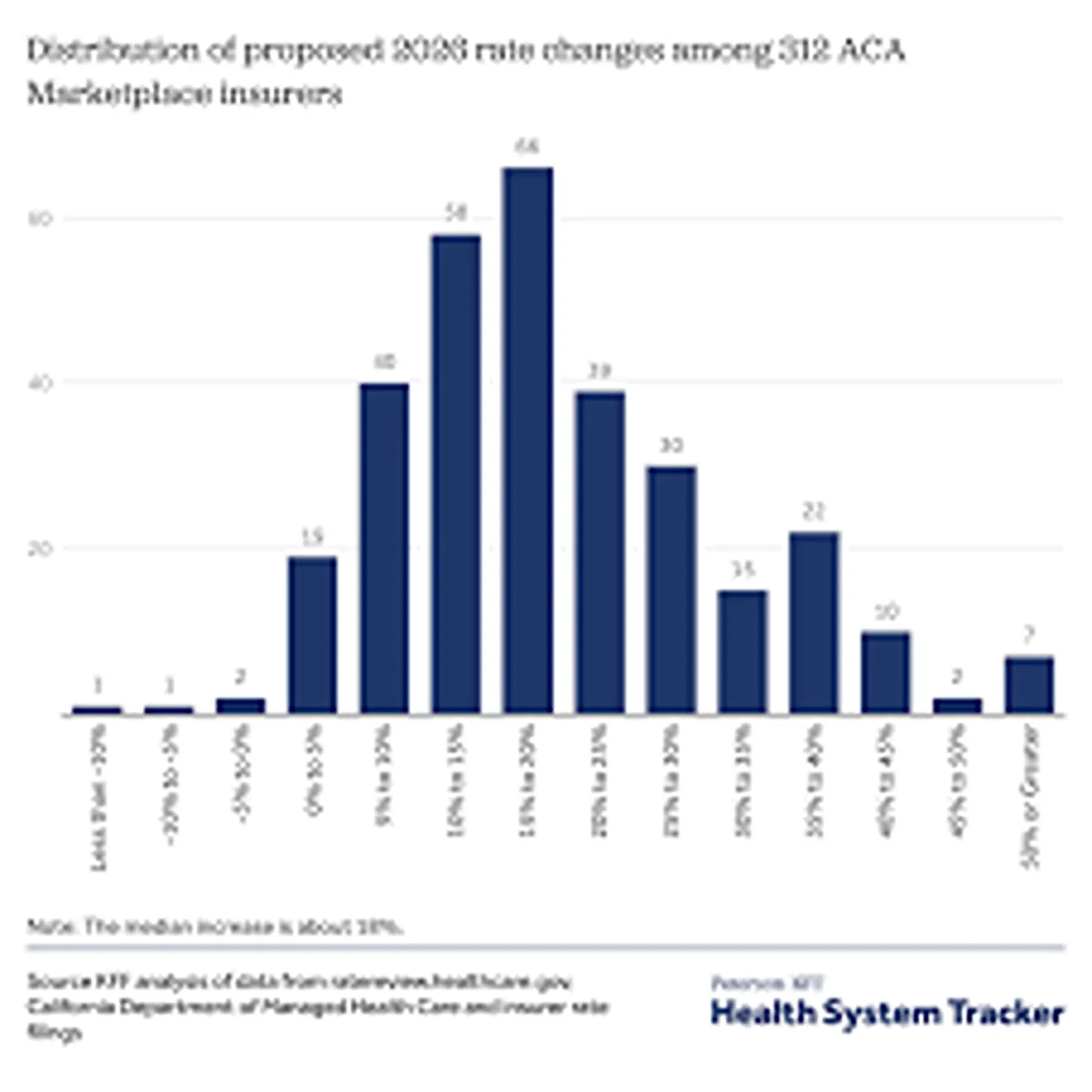

Health insurance continues to dominate U.S. consumer search trends, especially during open enrollment periods. According to data released by the Centers for Medicare & Medicaid Services, enrollment in Affordable Care Act marketplace plans remains strong, with premium subsidies helping offset rising medical costs for millions of Americans.

However, insurers report that healthcare utilization has rebounded significantly following pandemic-era slowdowns. Hospital expenses, prescription drug prices, and specialty care are key drivers of premium adjustments.

Employer-sponsored health insurance, which covers the majority of working Americans, is also seeing moderate premium growth. Large insurers are expanding telehealth services and preventive care incentives in an effort to manage long-term costs and improve health outcomes.

For consumers, understanding deductibles, out-of-pocket maximums, and provider networks has become increasingly important as plan structures grow more complex.

Life inurance sales have seen renewed momentum, particularly among millennials and Gen Z consumers. Industry surveys show heightened financial awareness following recent economic uncertainty and public health events.

Major carriers, including Prudential Financial, report increased interest in term life products due to their affordability and straightforward coverage structure. Digital underwriting and accelerated approval processes are making it easier for younger applicants to secure policies without extensive medical exams.

Financial advisors note that many first-time buyers are prioritizing income protection and debt coverage, especially homeowners with mortgages or families with young children. Online comparison tools and direct-to-consumer platforms have also reshaped how Americans shop for life coverage.

Regulatory Oversight and Market Stability

Insurance regulation in the United States operates primarily at the state level. Organizations such as the National Association of Insurance Commissioners play a coordinating role by developing model laws and monitoring industry solvency.

Despite premium volatility in certain segments, regulators report that most major insurers maintain strong capital reserves. Risk-based capital requirements and stress testing frameworks are designed to protect policyholders even during catastrophic loss years.

Lawmakers in several states are also examining consumer protection measures, including clearer policy disclosures and improved claims transparency. These discussions are particularly active in regions affected by repeated climate-related losses.

Digital Transformation Reshaping Consumer Experience

Technology continues to redefine how Americans purchase and manage insurance. Mobile apps, AI-driven risk assessments, and usage-based auto insurance programs are gaining traction. Telematics devices, for example, allow insurers to price policies based on real driving behavior rather than generalized demographic data.

Insurtech startups are challenging traditional business models by offering faster quotes and simplified policy management. Meanwhile, established carriers are investing heavily in digital infrastructure to streamline claims processing and enhance customer engagement.

Cybersecurity insurance is another rapidly growing segment, particularly for small and medium-sized businesses facing increased digital threats. As cyber incidents become more frequent, demand for specialized coverage is expanding across industries.

What U.S. Consumers Should Watch in 2026

Looking ahead, several factors will likely influence insurance pricing and availability in the United States:

- Ongoing climate risk exposure and catastrophe losses

- Medical cost inflation and pharmaceutical pricing trends

- Vehicle technology advancements and repair complexity

- Regulatory reforms at the state level

- Broader economic indicators, including interest rates

For consumers, comparison shopping remains one of the most effective strategies for managing insurance costs. Reviewing policy terms annually, bundling coverage where appropriate, and maintaining strong credit profiles can help mitigate premium increases.

While the insurance market is navigating a period of adjustment, it continues to play a critical role in financial protection for American households and businesses. As risks evolve, so too does the industry’s approach to underwriting, pricing, and customer service — making informed decision-making more important than ever.