U.S. Loan Market 2026- The U.S. loan market is entering 2026 with a mix of caution and opportunity as interest rates remain elevated compared to pre-pandemic levels, credit standards tighten, and borrowers adjust to a higher-cost environment. From mortgages and auto loans to student debt and small business financing, Americans are navigating a landscape shaped by Federal Reserve policy, resilient consumer spending, and evolving lender strategies. Here’s a comprehensive look at how the loan market is performing and what it means for households and businesses across the country.

Interest Rates Remain the Central Story

Interest rates continue to drive borrowing decisions in the United States. After aggressive rate hikes in 2022 and 2023 aimed at cooling inflation, the Federal Reserve has moved more cautiously, keeping benchmark rates higher for longer to ensure price stability.

As a result, average borrowing costs remain well above the historic lows seen during 2020 and 2021. Mortgage rates have hovered near multi-year highs, while credit card APRs remain elevated. Even though inflation has moderated compared to its peak, lenders are pricing loans with a focus on risk management and profitability.

For consumers, this means monthly payments are significantly higher than they were just a few years ago, even if loan amounts remain similar. Financial advisors note that borrowers are increasingly shopping around, comparing offers online, and prioritizing fixed-rate products over variable-rate options.

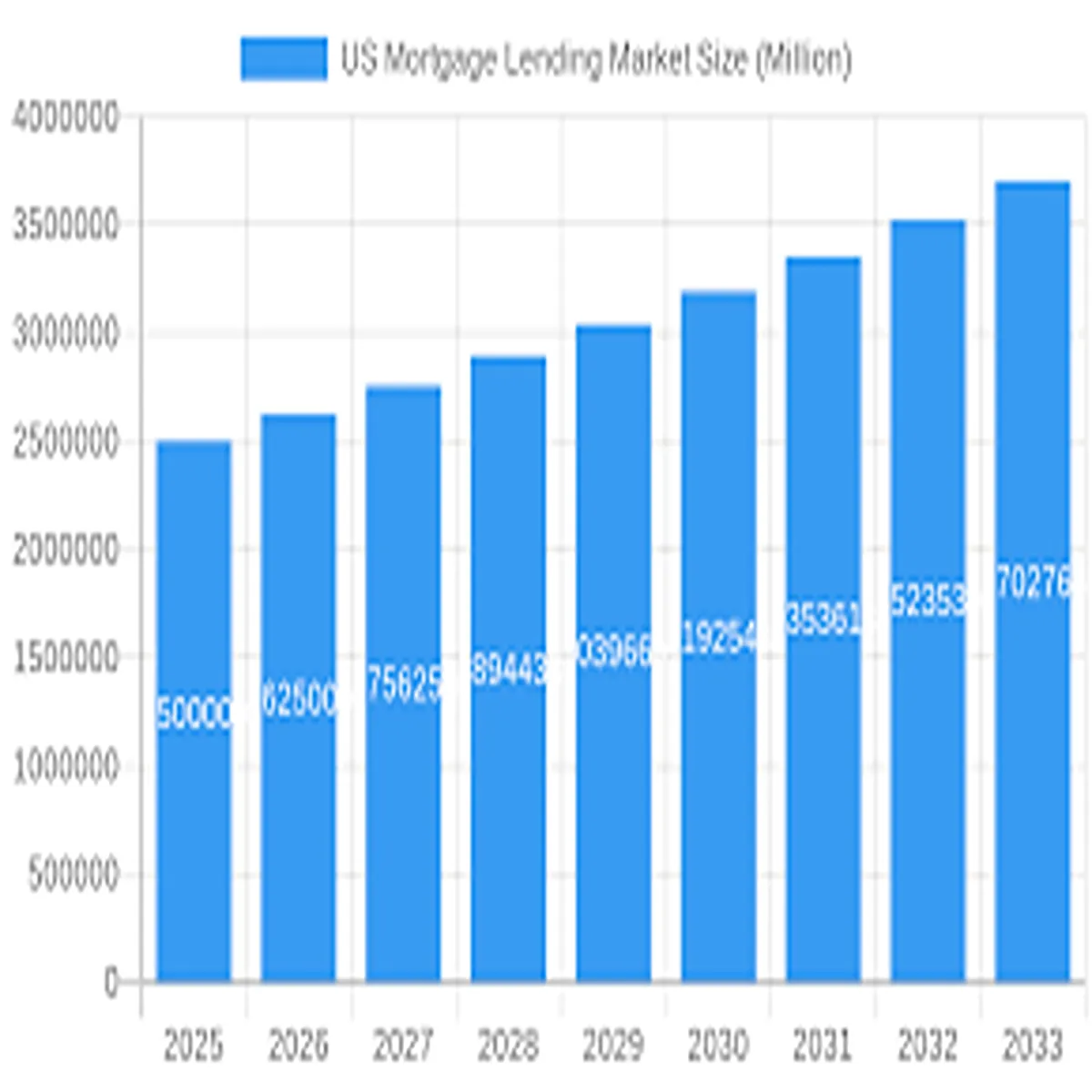

Mortgage Loans: Slower Sales, Higher Payments

The housing sector continues to feel the impact of higher rates. According to data from the Mortgage Bankers Association, mortgage application activity has fluctuated as buyers respond to rate changes and limited housing inventory.

Home affordability remains a major challenge. Even modest increases in rates can add hundreds of dollars to monthly mortgage payments, reducing purchasing power. Many homeowners who locked in ultra-low rates during the pandemic are reluctant to sell, creating a “lock-in effect” that constrains housing supply.

Refinancing activity, once a dominant trend, is now significantly lower compared to peak years. However, lenders are offering targeted programs for first-time buyers, including down payment assistance and adjustable-rate mortgage (ARM) options.

Auto Loans Show Signs of Strain

Auto financing has also tightened. As vehicle prices remain elevated, longer loan terms — often 72 months or more — have become more common. This helps lower monthly payments but increases total interest paid over time.

Recent reports from the Federal Reserve Bank of New York highlight a gradual rise in delinquency rates on auto loans, particularly among subprime borrowers. While overall default levels are not at crisis levels, analysts say rising credit stress among lower-income households bears monitoring.

Lenders are responding by tightening underwriting standards, especially for borrowers with lower credit scores. At the same time, digital lending platforms are expanding pre-approval tools, allowing consumers to compare financing before visiting dealerships.

Student Loan Repayment Reshapes Household Budgets

After pandemic-era pauses ended, federal student loan repayments resumed, impacting millions of Americans. The U.S. Department of Education has rolled out income-driven repayment plans designed to ease monthly burdens, but many borrowers are still adjusting their budgets.

For younger households, student loan payments compete with rent, car payments, and credit card balances. Financial planners say this shift is influencing broader spending patterns, potentially slowing discretionary purchases in sectors like travel and retail.

Private student loan lenders, meanwhile, are emphasizing flexible repayment options and refinancing opportunities for borrowers with strong credit profiles.

Small Business Lending Faces Tighter Standards

Small businesses, especially in retail and hospitality, are facing more selective lending conditions. Community banks and credit unions remain active in local markets, but underwriting standards have generally tightened in response to economic uncertainty.

Programs backed by the U.S. Small Business Administration continue to support entrepreneurs through government-backed guarantees. However, higher interest rates mean borrowing costs for equipment financing, working capital loans, and commercial real estate have increased.

Business owners are increasingly turning to alternative lenders and fintech platforms for faster approvals, though these options often carry higher interest rates.

Credit Cards and Personal Loans Gain Popularity

As traditional borrowing becomes more expensive, unsecured credit products are seeing strong demand. Credit card balances have reached record levels, reflecting both higher spending and elevated interest rates.

Personal loans are also gaining traction, particularly for debt consolidation. Borrowers are using fixed-rate personal loans to manage high-interest credit card debt, seeking predictable monthly payments.

Financial experts caution that while consolidation can reduce overall costs, borrowers should carefully review origination fees and loan terms before committing.

What Borrowers Should Watch in 2026

Looking ahead, several factors will shape the U.S. loan market:

- Federal Reserve rate decisions

- Inflation trends and labor market strength

- Consumer credit performance

- Regulatory updates affecting lending standards

Economists expect gradual stabilization if inflation remains under control, but significant rate cuts are not guaranteed. Borrowers are advised to monitor their credit scores, compare multiple lenders, and avoid overextending their budgets in a high-rate environment.

For households considering major financial commitments — such as buying a home or expanding a business — timing and preparation remain critical. Strong credit, lower debt-to-income ratios, and emergency savings can significantly improve loan approval chances and interest rates.

A Market Adjusting, Not Collapsing

Despite headlines focusing on rising delinquencies or higher borrowing costs, most analysts agree the U.S. loan market is adjusting rather than deteriorating. Lending standards are more disciplined than during past financial crises, and banks hold stronger capital positions.

Consumers, meanwhile, are becoming more strategic. Online comparison tools, financial education resources, and transparent loan marketplaces are helping borrowers make informed decisions.

As 2026 unfolds, the story of loans in America is less about rapid expansion and more about recalibration. Higher rates have reshaped borrowing behavior, but credit remains widely available for qualified applicants. For many Americans, careful planning — rather than easy money — is now the key to navigating the evolving loan landscape.