U.S. Insurance- The U.S. insurance market is entering 2026 under mounting pressure from rising claims costs, climate-related disasters, healthcare inflation, and tighter regulatory scrutiny. From auto and home insurance to health and life coverage, American consumers are seeing premium increases that reflect broader economic and environmental shifts. At the same time, insurers are investing heavily in technology, risk modeling, and digital platforms to remain competitive in an evolving marketplace. Here’s a comprehensive look at what’s shaping the insurance landscape across the United States this year.

Auto Insurance Rates Continue Upward Trend

Auto insurance premiums remain one of the biggest concerns for U.S. households. According to recent industry data, average full-coverage auto insurance rates have increased significantly over the past two years. Several factors are driving this trend:

- Higher vehicle repair costs: Modern cars equipped with advanced driver-assistance systems (ADAS) and sensors are more expensive to repair.

- Increased accident severity: Post-pandemic driving patterns have contributed to more severe crashes in some regions.

- Litigation expenses: Rising legal settlements and jury awards are adding pressure to insurers’ loss ratios.

Major insurers including State Farm, GEICO, and Progressive have filed rate adjustments in multiple states, subject to regulatory approval. State regulators continue reviewing these increases to balance insurer solvency with consumer protection.

Consumers are responding by shopping for competitive quotes, increasing deductibles, and enrolling in usage-based insurance programs that track driving behavior.

Home Insurance Impacted by Climate Risks

Homeowners insurance is facing unprecedented challenges, particularly in high-risk states such as Florida and California. Hurricanes, wildfires, floods, and severe storms have resulted in billions of dollars in insured losses over recent years.

In response, some insurers have:

- Limited new policy issuance in high-risk ZIP codes

- Increased deductibles for wind and wildfire coverage

- Adjusted underwriting standards

Companies such as Allstate and Farmers Insurance have scaled back exposure in certain disaster-prone regions, citing risk concentration and reinsurance costs.

State-backed insurance pools and “insurers of last resort” are seeing increased enrollment. However, policy experts caution that long-term sustainability depends on improved building codes, climate mitigation strategies, and reinsurance market stability.

Health Insurance Costs and Policy Updates

Health insurance remains a central issue for American families. Under the framework of the Affordable Care Act, millions of Americans continue to receive coverage through federal and state marketplaces.

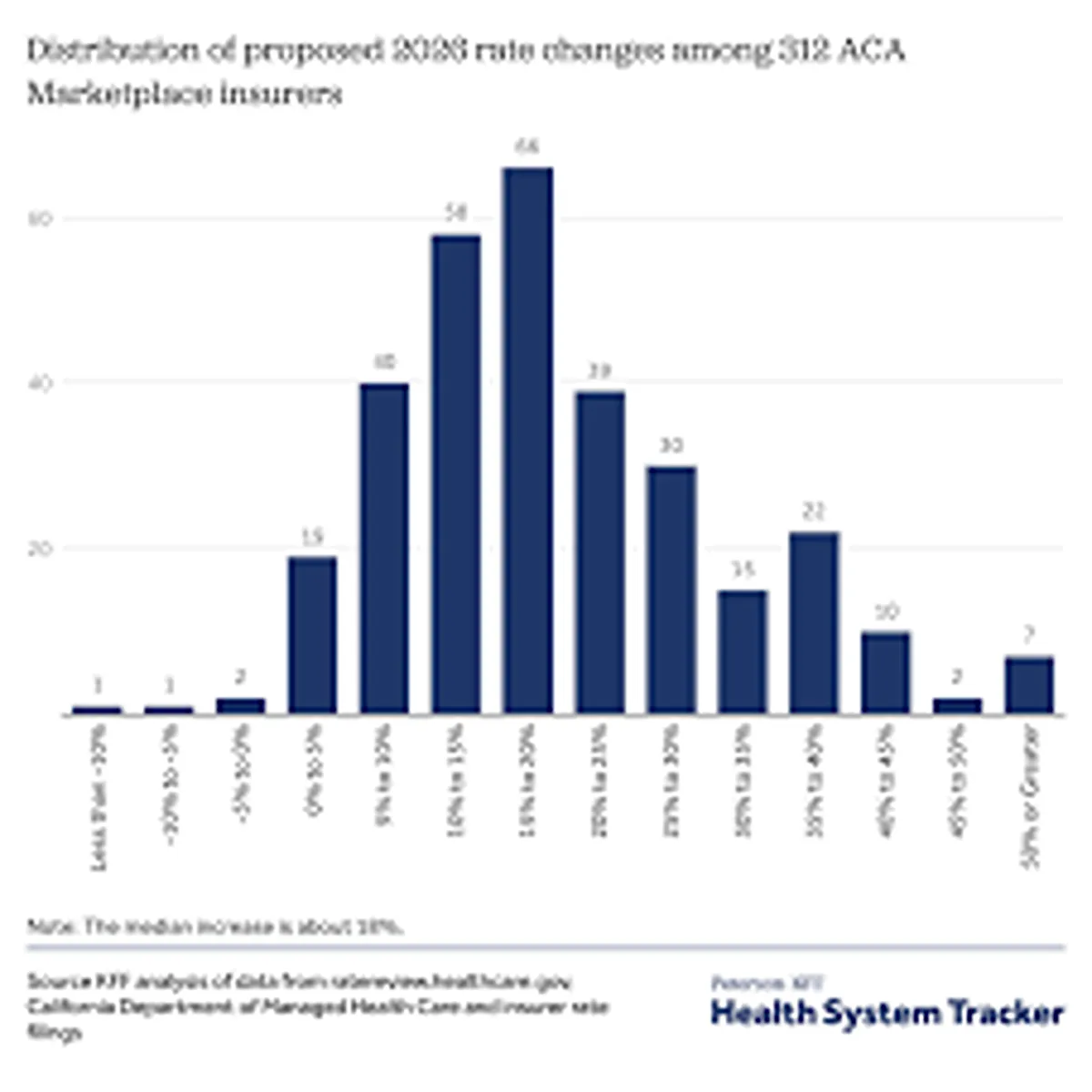

Premium adjustments in 2026 reflect:

- Medical inflation and rising prescription drug costs

- Increased demand for specialty and mental health services

- Expanded preventive care benefits

Insurers such as UnitedHealthcare and Blue Cross Blue Shield are expanding digital health tools, telemedicine services, and AI-driven claims processing to reduce administrative costs and improve customer experience.

Policy analysts note that federal subsidy structures remain critical in maintaining affordability for middle-income households. Enrollment trends suggest that marketplace participation remains steady, though regional premium differences persist.

Life Insurance Gains Attention Amid Economic Uncertainty

Life insurance demand has shown resilience, particularly among younger demographics seeking financial protection amid economic uncertainty. Industry reports indicate growing interest in term life policies due to affordability and simplicity.

Digital-first providers and established firms alike are streamlining underwriting with data analytics and simplified medical questionnaires. This shift reduces approval times and improves access for middle-income applicants.

Financial advisors emphasize that life insurance plays a broader role in estate planning, debt protection, and income replacement. As mortgage rates and living costs fluctuate, many families are reassessing coverage levels to align with evolving financial obligations.

Technology Reshapes the Insurance Marketplace

The insurance sector is undergoing rapid digital transformation. Insurtech startups are partnering with traditional carriers to enhance customer engagement, automate claims handling, and refine risk modeling.

Key trends include:

- AI-powered underwriting

- Telematics-based pricing

- Automated fraud detection

- Customer self-service mobile apps

While technology promises operational efficiency, regulators are closely monitoring algorithmic fairness and data privacy compliance. Consumer advocates continue urging transparency in how pricing models use personal data.

Regulatory Focus and Consumer Protection

Insurance regulation in the United States remains state-based, with each state department of insurance overseeing rate filings and market conduct. Recent legislative discussions focus on:

- Strengthening climate risk disclosures

- Enhancing consumer complaint resolution processes

- Reviewing reinsurance market practices

Federal agencies are also studying systemic risk exposure linked to climate events and catastrophic losses.

What U.S. Consumers Can Do Now

With insurance premiums rising across several categories, experts recommend that consumers:

- Review policies annually

- Compare quotes from multiple carriers

- Consider bundling home and auto coverage

- Maintain strong credit profiles

- Explore available state or federal assistance programs

Transparency, comparison shopping, and proactive risk management remain essential strategies in a tightening market.

Outlook for the U.S. Insurance Industry

Looking ahead, the U.S. insurance market is expected to remain dynamic through 2026. Economic conditions, disaster frequency, healthcare inflation, and regulatory decisions will continue shaping premium trends.

While cost pressures are real, industry leaders stress that maintaining solvency ensures long-term claims-paying ability — a cornerstone of financial stability for millions of American households.

For consumers, staying informed and reviewing coverage options regularly will be critical as the insurance landscape evolves.