U.S. Insurance Market 2026- The U.S. insurance industry is entering 2026 facing a mix of rising premiums, regulatory shifts, and changing consumer expectations. From homeowners in climate-prone states to drivers renewing auto coverage and families shopping for health plans, Americans are seeing measurable changes in both pricing and policy structures. Recent filings, earnings reports, and federal data indicate that while insurers remain financially stable overall, cost pressures linked to inflation, natural disasters, medical expenses, and litigation trends are reshaping the market across multiple lines of coverage.

Auto Insurance Rates Continue Upward Trend

Auto insurance remains one of the most searched and discussed coverage categories in the U.S., and recent data show why. According to industry filings and state regulatory disclosures, average auto premiums rose again in 2025 after sharp increases in the prior two years. Car repair costs, driven by advanced vehicle technology and supply chain pricing, remain elevated. Modern vehicles equipped with sensors, cameras, and driver-assistance systems are safer, but significantly more expensive to repair after even minor accidents.

Major carriers such as State Farm and GEICO have reported higher claims severity, prompting rate adjustments in several states. At the same time, insurers are tightening underwriting standards in high-risk urban markets.

For consumers, comparison shopping remains critical. Usage-based insurance programs, which monitor driving behavior via telematics, continue to expand as insurers compete for lower-risk drivers. Analysts note that while rate increases are moderating compared to 2023–2024 spikes, affordability concerns persist, especially for younger drivers.

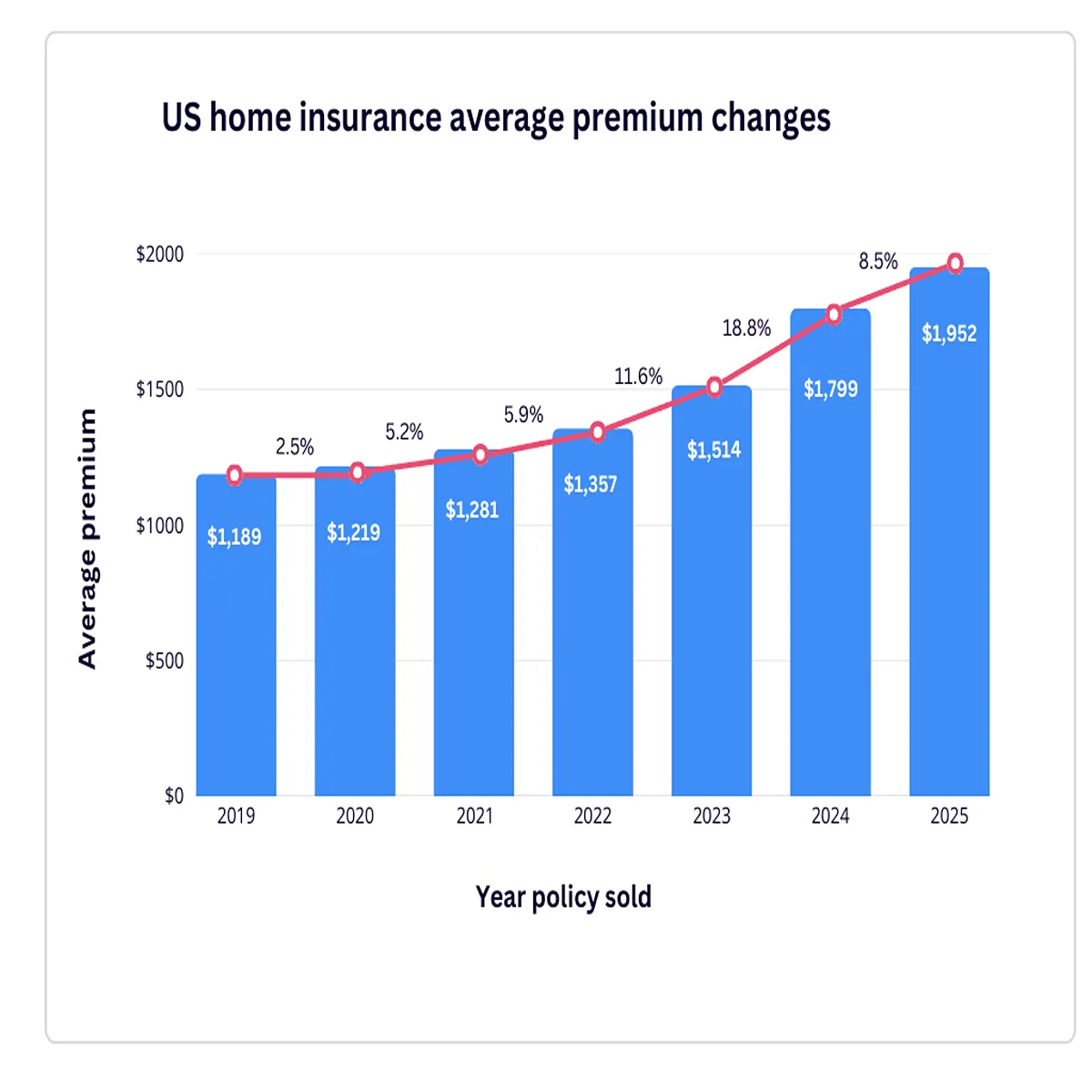

Homeowners Insurance Pressured by Climate Risks

Homeowners insurance is facing some of the most dramatic shifts in the U.S. insurance market. Severe weather events—including hurricanes, wildfires, and severe convective storms—have increased insured losses across multiple states. According to publicly reported catastrophe data, 2023 and 2024 ranked among the costliest years on record for weather-related claims.

States like Florida and California remain under particular stress. Some national insurers have reduced new policy issuance or adjusted coverage limits in high-risk ZIP codes. In California, wildfire exposure has led to policy non-renewals, prompting more homeowners to rely on state-backed insurance pools.

Companies including Allstate and Farmers Insurance have publicly addressed catastrophe exposure in earnings calls, citing the need for rate adequacy and reinsurance cost management.

For homeowners, mitigation steps—such as fortified roofs, wildfire-resistant landscaping, and updated plumbing systems—are increasingly tied to underwriting eligibility and premium discounts. Insurance experts recommend annual policy reviews, particularly as property replacement costs fluctuate.

Health Insurance Costs and Policy Changes in 2026

Health insurance remains one of the most critical financial considerations for American households. Marketplace enrollment under the Affordable Care Act has reached record levels in recent years, aided by enhanced federal subsidies. However, insurers continue to signal moderate premium adjustments for 2026, largely due to medical cost inflation and higher utilization rates.

Leading insurers such as UnitedHealthcare and Anthem have highlighted rising outpatient care costs and specialty drug spending in quarterly reports. Prescription drug pricing remains a key driver of overall claims expenses.

At the federal level, regulators continue to review subsidy structures and network adequacy requirements. For consumers, open enrollment comparisons—evaluating premiums, deductibles, and provider networks—are essential, especially as plan offerings vary by county.

Life Insurance Demand Steady but Evolving

Life insurance purchasing patterns have shifted since the pandemic, with more Americans seeking term life policies. Online-first platforms and accelerated underwriting processes have made coverage applications faster, often eliminating traditional medical exams for certain age groups and coverage amounts.

Established insurers like New York Life and Prudential Financial are expanding digital tools to streamline policy issuance. Meanwhile, insurtech firms continue to target younger demographics comfortable with fully digital transactions.

Financial advisors emphasize that while term life remains the most affordable entry point, consumers should evaluate long-term needs, especially when balancing mortgage obligations, college savings plans, and retirement strategies.

Regulatory Oversight and Market Stability

Despite premium increases across multiple sectors, U.S. insurers overall maintain solid capital reserves, according to statutory financial statements filed with state regulators. Insurance remains primarily regulated at the state level, with departments of insurance reviewing and approving rate changes.

Reinsurance costs—insurance purchased by insurers themselves—have risen globally, contributing to premium adjustments domestically. However, rating agencies continue to describe the U.S. property and casualty sector as financially resilient, though under earnings pressure.

Policymakers are also evaluating consumer protection measures, including transparency in rate filings and restrictions on non-renewals in disaster-affected areas.

What U.S. Consumers Should Watch in 2026

Insurance experts advise Americans to focus on three key areas this year:

- Policy Reviews: Annual reviews can uncover outdated coverage limits or missed discounts.

- Bundling Options: Combining home and auto policies may provide savings.

- Deductible Adjustments: Higher deductibles can lower premiums but increase out-of-pocket exposure.

Digital comparison tools and independent agents remain valuable resources for navigating a complex insurance marketplace.

Outlook: Stabilization or Continued Increases?

While some analysts expect rate increases to moderate in late 2026 if inflation continues to ease, structural challenges—climate risk, healthcare spending, and litigation trends—are likely to keep upward pressure on certain insurance segments.

For now, the U.S. insurance market reflects a recalibration period: insurers are refining risk models, regulators are monitoring consumer impact, and households are reassessing coverage needs amid broader economic uncertainty.

As insurance remains a foundational part of personal financial planning in America, staying informed—and proactive—may be the most effective strategy in a changing coverage landscape.